Maybe you’ve never thought much about it. Or about why you need it. Or what happens if you don’t get some. We can say this: Standing in the middle of your apartment, wondering where all your stuff went and what you’re gonna do next… is not the best time to learn about the benefits of renters insurance. Now is a much better time to understand why getting Toggle® is a really good idea.

Theft protection

First of all, renters insurance can cover your personal belongings in the event of theft. Think of your apartment or rental unit as a box. At its most basic, renters insurance can cover the things in the box—your things. It does not cover the box itself—that’s up to the landlord. So in the event someone takes your things from your box, it’s good to have renters insurance that can cover the replacement cost of the items stolen. And given renters are more likely to be victims of burglary than homeowners, this particular benefit is a big one.

Outside of your box?

But what if you take something that’s in your box, out of your box? That is to say, what if you buy extra coverage for your laptop under renters insurance, and then it gets stolen while you’re at the coffee shop or traveling out of town with it?

Most people don’t know that renters insurance can help in those situations too. Just Toggle OnSM Technology coverage, adding it to your policy, and you’re good to go. Not bad, right? Well, that’s not the half of it.

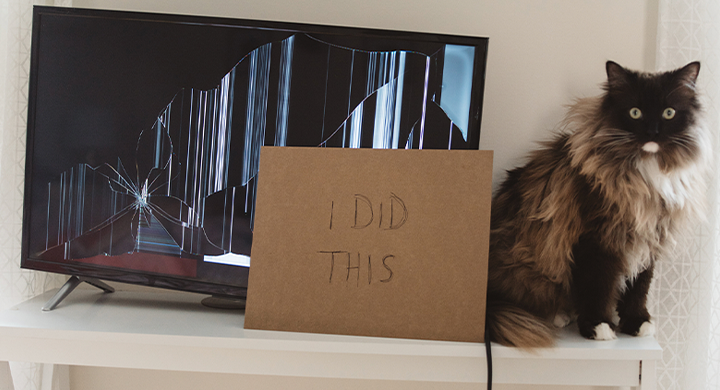

Damage protection

What if your box catches fire or gets soaked and ruins all your stuff? When it comes to damage as a result of fire, smoke and water, renters insurance once again can provide personal property coverage. Your Toggle coverage can help cover the cost of replacing the contents of your box. Not only that, but renters insurance can also help with your sudden increased living expenses, including the cost of your temporary housing if your rental is uninhabitable while repairs are being made.

Don’t-get-screwed-if-you-get-sued protection

This next thing is something most renters never consider: liability. What’s liability? Well, let’s say someone comes to visit you. They accidentally slip and fall in your shower, and crack their noggin in the process. That klutzy visitor can sue you for their medical expenses. If they do, renters insurance handles it—both your legal expenses and any medical expenses you might be responsible for, up to the coverage limit.

“But my friends would never sue me!” you say? Well, they might not have any choice. They might be facing going broke. It’s a real problem, as you’re probably aware that medical expenses in this country are obscenely high, and health insurance companies generally don’t like paying for them if they don’t need to. Suffice it to say, people don’t just sue friends because they’re being mean or greedy. Sometimes it’s just business. And if you’ve got renters insurance, you’ll be protected from that business. So, all cool in the end on this one.

Or, what if you start a stove fire late one night, mess up your apartment and now your landlord is hunting you down for damage money? Same deal on both. No biggie. Renters insurance covers your liability up to your coverage limits.

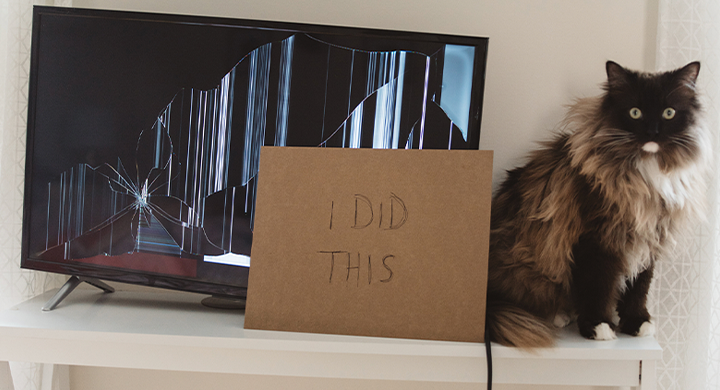

Here’s another liability situation most people never think of: What if you accidentally cause damage to someone else’s stuff and they don’t have renters insurance? Say you trip and accidentally shatter a friend’s tropical fish tank. Your renters insurance can save that day, too. And probably your friendship.

If this is beginning to seem like you get protection for not an awful lot of money (less than a fancy cup of coffee a month), well then you’re starting to get the idea. Buying renters insurance is one of those groovy little secrets nobody ever tells. Of course, that’s probably because only about 43% of all renters have renters insurance.

Extra Credit Bonus!

What’s even more, at Toggle, we’re working every day to fill the gaps in coverage and can cover benefits other policies might overlook or exclude. The Toggle Pet Parent℠ program provides up to $100,000 protection for you for any injury caused to someone else by your pet. Plus, $500 pet boarding costs if your place gets completely wrecked by a covered loss, needs repairs and you have to vacate. Plus, plus, you get $500 coverage for damages your pet causes to your rental that exceed your security deposit. Plus, plus, plus, Toggle offers $500 in veterinary care if your pet gets injured as a result of a covered disaster.

The best part about Toggle? All the benefits we’ve listed above are adjustable. (Or customizable. Your choice). So, yeah. How about the benefits of renters insurance as told by a company trying to revolutionize renters insurance? Pretty amazing stuff, and the cost, depending on your level of coverage, can be less than a cup of coffee a day or the fee for a monthly streaming service. Go get you some.

Learn more great tips about adulting here.